irs child tax credit payment dates

More than 9 million individuals and families could be leaving money on the table by not filing a 2021 federal tax return according to the IRS. My submitted 8812 to the IRS showed 4000 in Child Tax Credit.

Will You Have To Repay The Advanced Child Tax Credit Payments

In 2022 the tax credit could be refundable up to 1500 a rise from 1400.

. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. Because of the COVID-19 pandemic the CTC was. Some of that money will come in the form of advance payments via either direct deposit or paper check of up to 300 per month per qualifying child on July 15 August 13.

Missing Advance Child Tax Credit Payment. For 2021 the credit amount is. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to.

As part of the American Rescue Act signed into law by President Joe Biden in. IR-2021-169 August 13 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their. The percentage depends on your income.

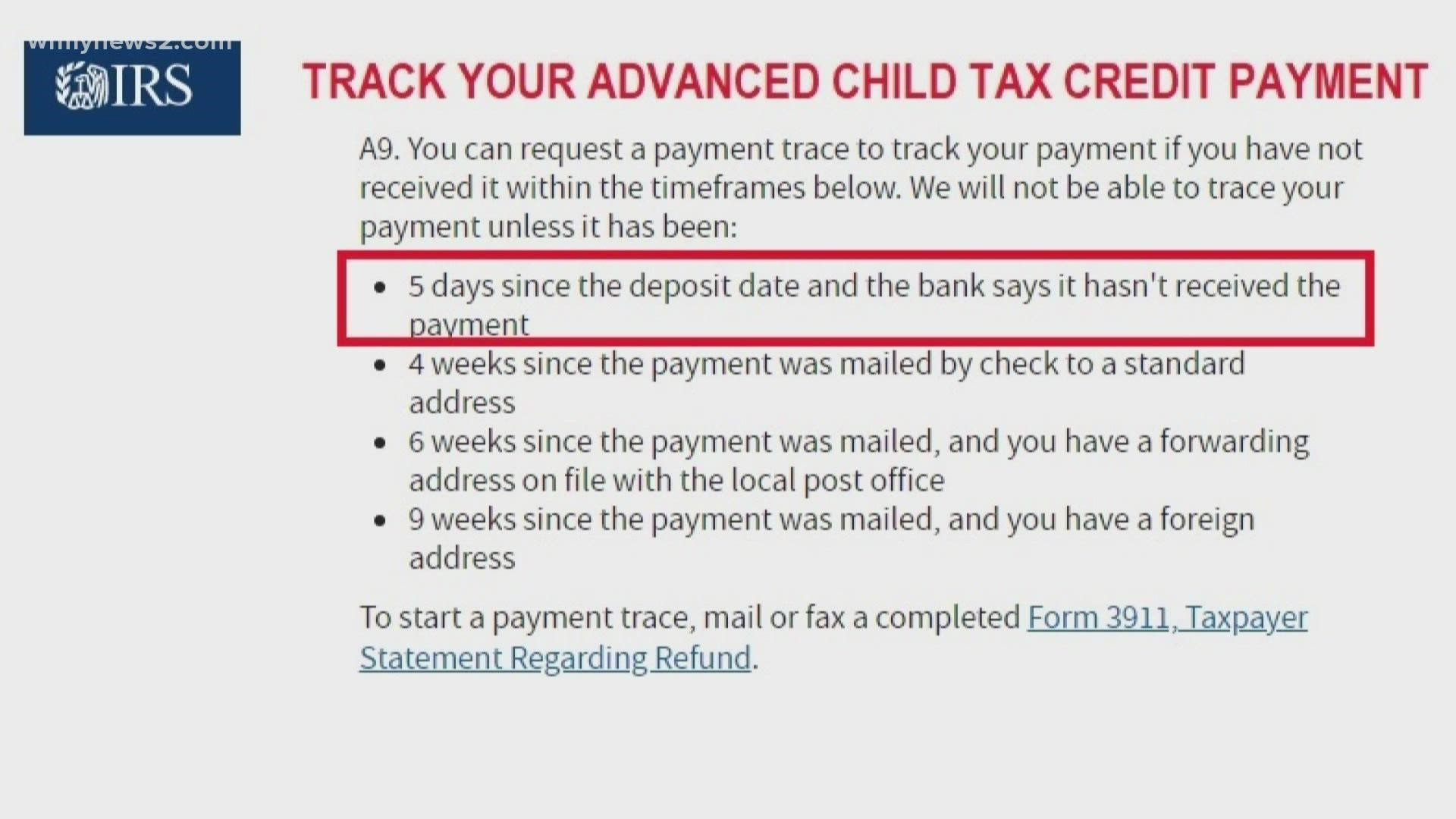

The IRS has announced the September child tax credits are on their way and future payment dates. A report by an IRS watchdog the Treasury Inspector General for Tax Administration TIGTA recently found that the agency correctly sent 98 of Child Tax Credit. Another reason the IRS could seize your child tax credit is if you have passed due federal debt.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. Advance Child Tax Credit Payments in 2021. The IRS said Wednesday that Septembers payments totalling nearly 15.

Canada FPT Payment Dates. Additionally households in Connecticut can claim up to. The credit amounts will increase for many.

Usually the payments are made on the fifth day of the payment month. The IRS has created a special Advance Child Tax Credit 2021 page with the most up-to-date information about the credit and the advance payments. Last week the federal tax agency.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. As earlier noted FPT payments related to GSTHST credits are issued quarterly. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The payment for the. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit.

IRS could seize your child tax credit part three. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. Very soon if you received advance payments of the Child Tax Credit you will be required to reconcile the payments received.

To satisfy past debts the. The IRS explains. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Here are the official dates. Half will come as six monthly payments and half as a 2021 tax credit.

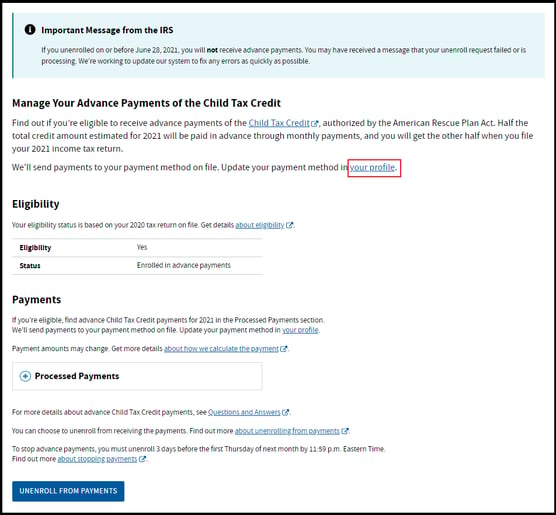

Reaction on the Hill. The IRS will pay 3600 per child to. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

The payments will be made either by direct deposit or by paper check depending on what.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit What We Do Community Advocates

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

Stimulus Update Important Dates For Next Child Tax Credit Payment When Will Money Arrive Al Com

What To Bring Campaign For Working Families Inc

Are You Missing The September Child Tax Credit Payment Wfmynews2 Com

New Child Tax Credit Monthly Advance Payments

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Child Tax Credit Advance Monthly Payments Explained Donovan

Last Day To Unenroll In July Advanced Child Tax Credit Payment

What You Need To Know About Advanced Child Tax Credit Payments Jfs

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Update Irs Sending Letters To Families Who May Get Monthly Payments Kiplinger